Installturbotax.com

Enter 16 digit License Code

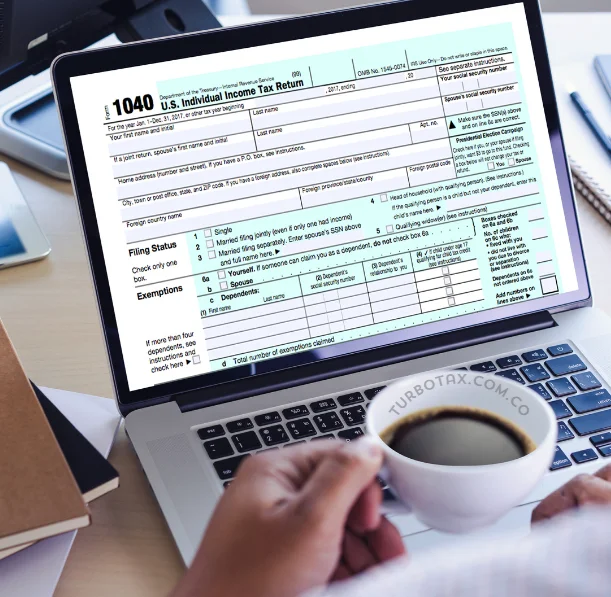

TurboTax is a tax preparation software that helps individuals and businesses file their tax returns accurately and efficiently. Developed by Intuit, TurboTax offers a range of products tailored to different tax situations, from simple returns to more complex scenarios involving investments, rental properties, and self-employment income. Here’s a step-by-step guide to help you register and install TurboTax online via “Installturbotax.com“.

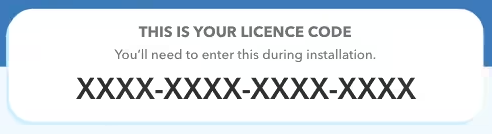

What is TurboTax License Code?

A TurboTax license code is a unique alphanumeric 16 digit code provided with your TurboTax purchase. This code is used to activate the software, ensuring that you have a legitimate copy and granting you access to all the features and benefits of TurboTax.

System Requirements for TurboTax

For Windows

- Operating System: Windows 10 or later

- Processor: 1 GHz or faster

- RAM: 2 GB or more

- Hard Disk Space: 1 GB

For Mac

- Operating System: macOS Mojave 10.14 or later

- Processor: Intel-based processor

- RAM: 2 GB or more

- Hard Disk Space: 1 GB

Download & Install TurboTax

- Visit Installturbotax.com and choose the TurboTax version that suits your needs (Free, Deluxe, Premier, or Self-Employed).

- Complete the purchase or select the free version if applicable.

- After purchasing, sign in to your TurboTax account or create a new one.

- Once logged in, go to the “Downloads” section of your account.

- Select your product and click “Download” to begin the process.

- Locate the downloaded file in your computer’s Downloads folder.

- Double-click the file and follow the on-screen prompts to install.

How to activate TurboTax with License Code?

- Open the Turbotax downloaded file on your computer.

- If you already have an Intuit account, sign in. If not, you’ll need to create one.

- You’ll be prompted to enter your license code. This code is usually found on the packaging or in your purchase confirmation email.

- After entering the license code, click “Continue” to complete the activation process.

Once activated, you can start using TurboTax to file your taxes.

Benefits of Filing Taxes with TurboTax

- Ease of Use: TurboTax guides you through the tax filing process with simple, straightforward questions tailored to your tax situation.

- Accuracy: Built-in error-checking tools ensure your return is accurate, reducing the likelihood of mistakes.

- Maximized Refunds: TurboTax searches over 350 deductions and credits, helping you get the biggest possible refund.

- Convenience: File your taxes from the comfort of your home, at any time. TurboTax is accessible via desktop and mobile devices.

- Import Capabilities: Easily import W-2s, 1099s, and other tax documents directly into the software.

- Audit Support: TurboTax provides guidance and resources in case of an IRS audit, including access to tax professionals.

- Customizable Options: Whether you’re a first-time filer, self-employed, or managing investments, TurboTax offers a product that fits your needs.

- Real-Time Updates: TurboTax keeps up with the latest tax laws, ensuring your return is compliant and up-to-date.